FAQ Shopper Category: Transfer and Remittance

Cross-border Lucky Money

How to receive Cross-border Lucky Money?

Cross-border Lucky Money will be transferred to the default bank account of the Alipay user in Mainland China. The recipient must collect the Cross-border Lucky Money within 48 hours after receiving the notification or the Cross-border Lucky Money will be cancelled and refunded.

- If the recipient has set up a default bank account via Alipay, the Cross-border Lucky Money can be transferred to the account within 15 minutes.

- If not, the recipient has to set up a default bank account within 72 hours after receiving the Cross-border Lucky Money (the Cross-border Lucky Money should be collected within 48 hours). For example, if the recipient collects the Cross-border Lucky Money two hours after receiving notification, he/she still has 70 hours left to set up a default bank account. After the bank account is successfully set up via Alipay, the Cross-border Lucky Money can be transferred to the account within 15 minutes.

What is the handling fee for sending Cross-border Lucky Money?

No handling fee.

What are the payment methods of Cross-border Lucky Money?

Cross-border Lucky Money can be paid by AlipayHK balance, bank account, or Ant Bank Libra Saving Account. Please ensure there is sufficient balance or completed linkage of a bank account or Ant Bank Libra Saving Account.

What is the amount limit of Cross-border Lucky Money?

The amount limit of each Cross-border Luck Money is RMB 50-520. Cross-border Lucky Money shares daily limit with Remittance, and shares yearly limit with all payment functions :

- Intermediate Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 100,000

- Advanced Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 300,000

- HKID Scanning and Live Selfie Verification Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 300,000

What is the difference between Cross-border Lucky Money and remittance?

AlipayHK users can send RMB 50-520 to verified Alipay users in Mainland China via Cross-border Lucky Money, but cannot send to their own accounts. In addition, customised greeting messages can be sent together with the Cross-border Lucky Money.

What is Cross-border Lucky Money?

AlipayHK users can send Cross-border Lucky Money to verified Alipay users in Mainland China. The Cross-border Lucky Money will be sent in HKD via AlipayHK app, while Alipay users in Mainland China receive the Cross-border Lucky Money in RMB. AlipayHK users can choose the Cross-border Lucky Money design cover that fits the purpose. The Alipay user in Mainland China will see the Cross-border Lucky Money design cover chosen by the sender.

Fund transfer

How to turn on/turn off Sound Alert

How to reject receiving the transfer from strangers

How to check Transaction History

How to use FPS

FPS Registration

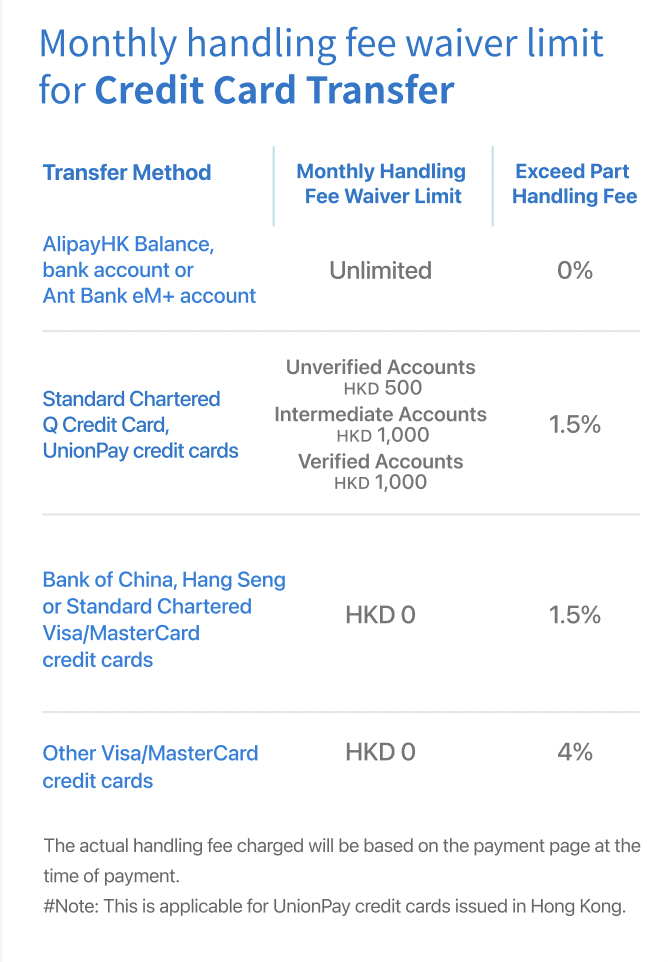

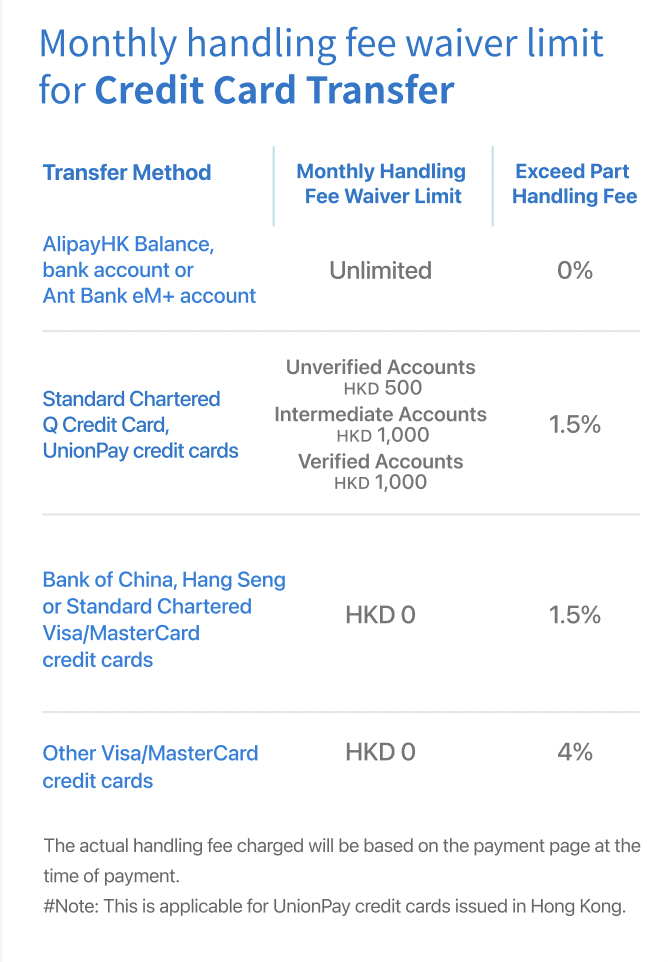

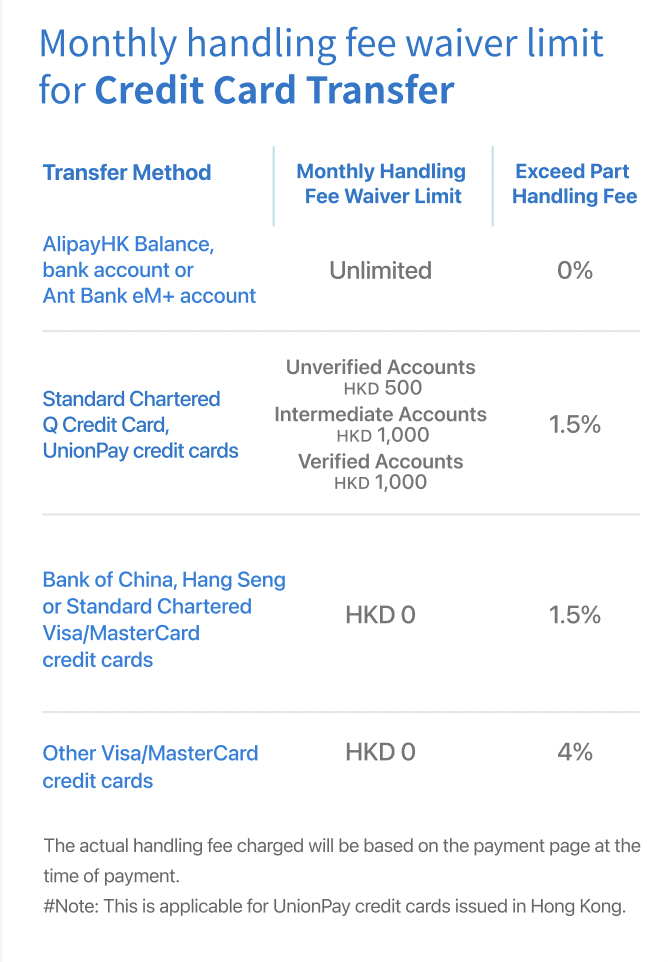

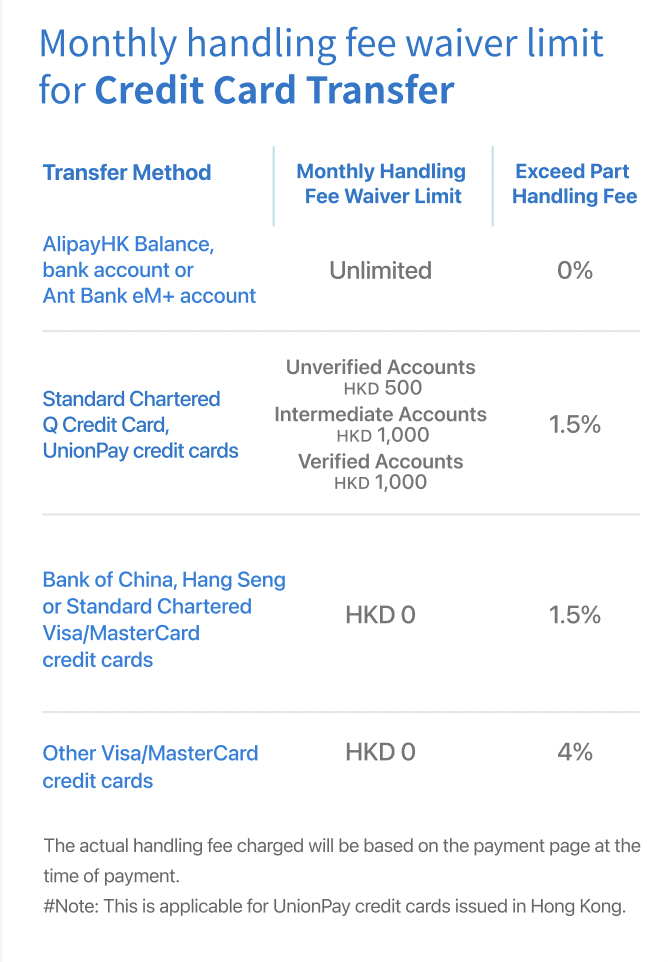

Transaction Fee of Fund Transfer

- There is no transaction fee for making transfer using AlipayHK balance, bank account or Ant Bank eM+ account.

- For users making transfers with a Standard Chartered Q Credit Card , or UnionPay credit card#, the handling fee waiver limit varies according to the verification level of the account: unverified accounts have a monthly handling fee waiver limit of HKD 500; intermediate verified accounts have a limit of HKD 1,000; fully verified accounts also have a limit of HKD 1,000. Should the waiver limit be exceeded, a handling fee of 1.5% will be applied for transfers.

- From 1st October 2024, a 1.5% handling fee will be charged for transfers made using Bank of China or Standard Chartered Bank or Hang Seng Bank Visa or MasterCard credit cards.

- A 4% handling fee will be charged for transfers made using other credit cards.

*Please refer to the actual transfer transaction for the current available handling fee waiver limits.

#Note: This is applicable for UnionPay credit cards issued in Hong Kong.

Updated on 26th September 2024

Make a transfer

Payment methods

Transfer to Alipay China

Cancel transfer

Transferred into an incorrect AlipayHK account

Transfer not received

Unable to transfer

Amount limit

Collecting payment

View collection record

Handling fee for receiving money

Unable to collect payment and collection limit

How to collect payment

Remittance

What are the acceptable sources of funds and transaction purposes (remittance reasons) for sending remittances to the Chinese mainland?

Remittances to the Chinese mainland are only acceptableed for the following sources and purposes and from the following sources of funds. Once the remittance is complete, you can use the funds for personal daily expenses:

- Salary Remittance: This primarily refers to remitting your own salary to the Chinese mainland. Alipay may request the recipient to provide recent bank statements salary transactions, pay slips, or labor employment contracts as supporting documents/evidence.

- Family Support Remittance: Suitable for remitting funds to direct relatives or family members in the Chinese mainland who are legally dependent on you. Alipay may request the recipient to provide proof of the familial relationship. If remitting funds to yourself, please select “Salary Remittance” as the purpose.

- Online Shopping: Refers to personal transactions made on online shopping platforms. Alipay may request the recipient to provide proof of the transaction, such as screenshots of platform sales and detailed information.

- Payment of Service Fees: Refers to fees arising from a service contract signed between you and the recipient. Alipay may request the recipient to provide supporting documents such as service contracts or agreements.

Notes:

- Salary and family support remittances are acceptable to recipients holding a People’s Republic of China Resident Identity Card and a Hong Kong/Macao Resident Home-return Permit.

- Online shopping and payment of service fees are only permissible for recipients verified with a People’s Republic of China Resident Identity Card.

For detailed reasons for remittance, please refer to the table below:

|

Relationship |

Purpose |

Detailed Remittance Reason |

|

Myself |

Salary Remittance |

/ |

|

Family Member |

Family Support Remittance |

/ |

|

Goods Seller |

Online Shopping |

|

|

Service provider |

Payment of Service Fees |

|

Transfer purpose and the source of funding

Ways to collect remittance and processing time

Remittance Limit

• For Intermediate accounts, the maximum remittance limits are HKD 7,999 daily and HKD 100,000 annually

• For Advanced accounts, the maximum remittance limits are HKD 20,000 daily and HKD 500,000 annually

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page.

• The minimum remittance amount is HKD 20 per transaction

The verification level should be of Intermediate or Advanced level for remittance in the Philippines:

• For Intermediate accounts, the maximum remittance limits are HKD 5,000 daily and HKD 60,000 annually (limit inclusive of other transactions)

• For Advanced accounts, the maximum remittance limits are HKD 5,000 daily and HKD 100,000 annually (limit inclusive of other transactions)

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page

• The minimum remittance amount is HKD 20 per transaction

To Indonesia (Only eligible to Advanced accounts):

• The daily limit is HKD 5,000 and the annual limit is HKD 100,000.

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page.

• The minimum remittance amount is HKD 20 per transaction

Remittance Method

Transaction fee

Starting from 13 December 2022, a handling fee of HKD 25 per transaction will be charged for remittance service to the Chinese mainland.

From 20 June 20 2023 to 30 June 2024, the minimum remittance amount eligible for fee waiver will be adjusted to RMB 6,500 or above per transaction. New users will still enjoy fee waiver for their first remittance.

To the Philippines:

Remittances to Bank Accounts/Pick Up will be charged a HKD 15 transaction fee.

Remittances to GCash eWallet has no transaction fee

To Indonesia:

HKD 15 transaction fee.

Exchange rate

Supported countries & currencies

Remittance payment method

The remittance function can only be performed through balance, bank account or Libra Savings transactions. Please ensure that your account has sufficient balance or connect any bank account or Libra Savings.

To the Philippines:

The remittance function can only be performed through balance transactions. Please ensure that your account has sufficient balance.

To Indonesia:

The remittance function can only be performed through balance, bank account or Libra Savings transactions. Please ensure that your account has sufficient balance or connect any bank account or Libra Savings.

Lucky Money

Will the Lucky Money link expire?

Why can’t the Lucky Money be paid using the remaining/AlipayHK balance?

Is there a transaction fee for sending Lucky Money?

Unverified Accounts: HKD 500

Intermediate Accounts: HKD 1,000

Advanced Accounts: HKD 1,000

HKID Scanning and Live Selfie Verification Accounts: HKD 1,000

If the transaction fee waiver limit is exceeded, the transaction fee of BOC credit cards is 1.5%, and that of other credit cards is 3%.

The transaction fee waiver limit of credit card transfer and Lucky Money function are calculated together.

Is it possible to collect Lucky Money without registering with AlipayHK?

What channels can be used for sharing the Lucky Money link?

Can the Lucky Money be withdrawn?

What is the maximum amount of each Lucky Money?

Maximum amount of Group Lucky Money: HKD 888; maximum number of Lucky Money is 300 units

Please take note of the following transaction limits for different accounts for payment using AlipayHK balance:

Unverified Accounts: HKD 3,000/ transaction;HKD 3,000/ day;HKD 25,000/ year。

Intermediate Accounts: HKD 10,000/ transaction;HKD 20,000/ day;HKD 100,000/ year。

Advanced Accounts: HKD 10,000/ transaction;HKD 30,000/ day;HKD 200,000/ year

HKID Scanning and Live Selfie Verification Accounts: HKD 10,000/ transaction;HKD 30,000/ day;HKD 200,000/ year

Can the Lucky Money be cancelled?

Can Lucky Money sending history be deleted?

Why the Lucky Money refund cannot be collected?

Please take note of the following money collection limits for different accounts:

Unverified Accounts: HKD 3,000/ transaction; HKD 25,000/ year; HKD 3,000/ account balance

Intermediate Accounts: HKD 5,000/ transaction; HKD 100,000/ year; HKD 100,000/ account balance

Advanced Accounts: HKD 5,000/ transaction; HKD 200,000/ year; HKD 100,000/ account balance

HKID Scanning and Live Selfie Verification Accounts: HKD 5,000/ transaction; HKD 200,000/ year; HKD 100,000/ account balance

Annual money collection limit is the collective amount from top-up, credit card, transfer and collection functions.

Can I send Lucky Money with fixed amount?

Can senders collect their own Lucky Money?

How to receive Cross-border Lucky Money?

Cross-border Lucky Money will be transferred to the default bank account of the Alipay user in Mainland China. The recipient must collect the Cross-border Lucky Money within 48 hours after receiving the notification or the Cross-border Lucky Money will be cancelled and refunded.

- If the recipient has set up a default bank account via Alipay, the Cross-border Lucky Money can be transferred to the account within 15 minutes.

- If not, the recipient has to set up a default bank account within 72 hours after receiving the Cross-border Lucky Money (the Cross-border Lucky Money should be collected within 48 hours). For example, if the recipient collects the Cross-border Lucky Money two hours after receiving notification, he/she still has 70 hours left to set up a default bank account. After the bank account is successfully set up via Alipay, the Cross-border Lucky Money can be transferred to the account within 15 minutes.

What is the handling fee for sending Cross-border Lucky Money?

No handling fee.

What are the payment methods of Cross-border Lucky Money?

Cross-border Lucky Money can be paid by AlipayHK balance, bank account, or Ant Bank Libra Saving Account. Please ensure there is sufficient balance or completed linkage of a bank account or Ant Bank Libra Saving Account.

What is the amount limit of Cross-border Lucky Money?

The amount limit of each Cross-border Luck Money is RMB 50-520. Cross-border Lucky Money shares daily limit with Remittance, and shares yearly limit with all payment functions :

- Intermediate Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 100,000

- Advanced Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 300,000

- HKID Scanning and Live Selfie Verification Accounts: Maximum daily limit is HKD 7,999 and yearly limit is HKD 300,000

What is the difference between Cross-border Lucky Money and remittance?

AlipayHK users can send RMB 50-520 to verified Alipay users in Mainland China via Cross-border Lucky Money, but cannot send to their own accounts. In addition, customised greeting messages can be sent together with the Cross-border Lucky Money.

What is Cross-border Lucky Money?

AlipayHK users can send Cross-border Lucky Money to verified Alipay users in Mainland China. The Cross-border Lucky Money will be sent in HKD via AlipayHK app, while Alipay users in Mainland China receive the Cross-border Lucky Money in RMB. AlipayHK users can choose the Cross-border Lucky Money design cover that fits the purpose. The Alipay user in Mainland China will see the Cross-border Lucky Money design cover chosen by the sender.

How to turn on/turn off Sound Alert

How to reject receiving the transfer from strangers

How to check Transaction History

How to use FPS

FPS Registration

Transaction Fee of Fund Transfer

- There is no transaction fee for making transfer using AlipayHK balance, bank account or Ant Bank eM+ account.

- For users making transfers with a Standard Chartered Q Credit Card , or UnionPay credit card#, the handling fee waiver limit varies according to the verification level of the account: unverified accounts have a monthly handling fee waiver limit of HKD 500; intermediate verified accounts have a limit of HKD 1,000; fully verified accounts also have a limit of HKD 1,000. Should the waiver limit be exceeded, a handling fee of 1.5% will be applied for transfers.

- From 1st October 2024, a 1.5% handling fee will be charged for transfers made using Bank of China or Standard Chartered Bank or Hang Seng Bank Visa or MasterCard credit cards.

- A 4% handling fee will be charged for transfers made using other credit cards.

*Please refer to the actual transfer transaction for the current available handling fee waiver limits.

#Note: This is applicable for UnionPay credit cards issued in Hong Kong.

Updated on 26th September 2024

Make a transfer

Payment methods

Transfer to Alipay China

Cancel transfer

Transferred into an incorrect AlipayHK account

Transfer not received

Unable to transfer

Amount limit

View collection record

Handling fee for receiving money

Unable to collect payment and collection limit

How to collect payment

What are the acceptable sources of funds and transaction purposes (remittance reasons) for sending remittances to the Chinese mainland?

Remittances to the Chinese mainland are only acceptableed for the following sources and purposes and from the following sources of funds. Once the remittance is complete, you can use the funds for personal daily expenses:

- Salary Remittance: This primarily refers to remitting your own salary to the Chinese mainland. Alipay may request the recipient to provide recent bank statements salary transactions, pay slips, or labor employment contracts as supporting documents/evidence.

- Family Support Remittance: Suitable for remitting funds to direct relatives or family members in the Chinese mainland who are legally dependent on you. Alipay may request the recipient to provide proof of the familial relationship. If remitting funds to yourself, please select “Salary Remittance” as the purpose.

- Online Shopping: Refers to personal transactions made on online shopping platforms. Alipay may request the recipient to provide proof of the transaction, such as screenshots of platform sales and detailed information.

- Payment of Service Fees: Refers to fees arising from a service contract signed between you and the recipient. Alipay may request the recipient to provide supporting documents such as service contracts or agreements.

Notes:

- Salary and family support remittances are acceptable to recipients holding a People’s Republic of China Resident Identity Card and a Hong Kong/Macao Resident Home-return Permit.

- Online shopping and payment of service fees are only permissible for recipients verified with a People’s Republic of China Resident Identity Card.

For detailed reasons for remittance, please refer to the table below:

|

Relationship |

Purpose |

Detailed Remittance Reason |

|

Myself |

Salary Remittance |

/ |

|

Family Member |

Family Support Remittance |

/ |

|

Goods Seller |

Online Shopping |

|

|

Service provider |

Payment of Service Fees |

|

Transfer purpose and the source of funding

Ways to collect remittance and processing time

Remittance Limit

• For Intermediate accounts, the maximum remittance limits are HKD 7,999 daily and HKD 100,000 annually

• For Advanced accounts, the maximum remittance limits are HKD 20,000 daily and HKD 500,000 annually

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page.

• The minimum remittance amount is HKD 20 per transaction

The verification level should be of Intermediate or Advanced level for remittance in the Philippines:

• For Intermediate accounts, the maximum remittance limits are HKD 5,000 daily and HKD 60,000 annually (limit inclusive of other transactions)

• For Advanced accounts, the maximum remittance limits are HKD 5,000 daily and HKD 100,000 annually (limit inclusive of other transactions)

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page

• The minimum remittance amount is HKD 20 per transaction

To Indonesia (Only eligible to Advanced accounts):

• The daily limit is HKD 5,000 and the annual limit is HKD 100,000.

• Remittance, in-store payments and online payments shall be included in and counted towards the same limit. For more details please refer to the limits displayed on the actual page.

• The minimum remittance amount is HKD 20 per transaction

Remittance Method

Transaction fee

Starting from 13 December 2022, a handling fee of HKD 25 per transaction will be charged for remittance service to the Chinese mainland.

From 20 June 20 2023 to 30 June 2024, the minimum remittance amount eligible for fee waiver will be adjusted to RMB 6,500 or above per transaction. New users will still enjoy fee waiver for their first remittance.

To the Philippines:

Remittances to Bank Accounts/Pick Up will be charged a HKD 15 transaction fee.

Remittances to GCash eWallet has no transaction fee

To Indonesia:

HKD 15 transaction fee.

Exchange rate

Supported countries & currencies

Remittance payment method

The remittance function can only be performed through balance, bank account or Libra Savings transactions. Please ensure that your account has sufficient balance or connect any bank account or Libra Savings.

To the Philippines:

The remittance function can only be performed through balance transactions. Please ensure that your account has sufficient balance.

To Indonesia:

The remittance function can only be performed through balance, bank account or Libra Savings transactions. Please ensure that your account has sufficient balance or connect any bank account or Libra Savings.

Will the Lucky Money link expire?

Why can’t the Lucky Money be paid using the remaining/AlipayHK balance?

Is there a transaction fee for sending Lucky Money?

Unverified Accounts: HKD 500

Intermediate Accounts: HKD 1,000

Advanced Accounts: HKD 1,000

HKID Scanning and Live Selfie Verification Accounts: HKD 1,000

If the transaction fee waiver limit is exceeded, the transaction fee of BOC credit cards is 1.5%, and that of other credit cards is 3%.

The transaction fee waiver limit of credit card transfer and Lucky Money function are calculated together.

Is it possible to collect Lucky Money without registering with AlipayHK?

What channels can be used for sharing the Lucky Money link?

Can the Lucky Money be withdrawn?

What is the maximum amount of each Lucky Money?

Maximum amount of Group Lucky Money: HKD 888; maximum number of Lucky Money is 300 units

Please take note of the following transaction limits for different accounts for payment using AlipayHK balance:

Unverified Accounts: HKD 3,000/ transaction;HKD 3,000/ day;HKD 25,000/ year。

Intermediate Accounts: HKD 10,000/ transaction;HKD 20,000/ day;HKD 100,000/ year。

Advanced Accounts: HKD 10,000/ transaction;HKD 30,000/ day;HKD 200,000/ year

HKID Scanning and Live Selfie Verification Accounts: HKD 10,000/ transaction;HKD 30,000/ day;HKD 200,000/ year

Can the Lucky Money be cancelled?

Can Lucky Money sending history be deleted?

Why the Lucky Money refund cannot be collected?

Please take note of the following money collection limits for different accounts:

Unverified Accounts: HKD 3,000/ transaction; HKD 25,000/ year; HKD 3,000/ account balance

Intermediate Accounts: HKD 5,000/ transaction; HKD 100,000/ year; HKD 100,000/ account balance

Advanced Accounts: HKD 5,000/ transaction; HKD 200,000/ year; HKD 100,000/ account balance

HKID Scanning and Live Selfie Verification Accounts: HKD 5,000/ transaction; HKD 200,000/ year; HKD 100,000/ account balance

Annual money collection limit is the collective amount from top-up, credit card, transfer and collection functions.